Irs tax refund calculator 2022

It will be updated with. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Top Tax Refund Calculators In 2022 To Estimate Irs Payments With New Child Tax Credit The Us Sun

This 2022 tax return and refund estimator provides you with detailed tax results during 2022.

. It is mainly intended for residents of the US. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. See What Credits and Deductions Apply to You.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Step 1 Run Your Numbers in the Tax Refund CalculatorEstimator.

The HR Block tax calculator 2022 is available online for. A simple tax return is. Check My Refund Status.

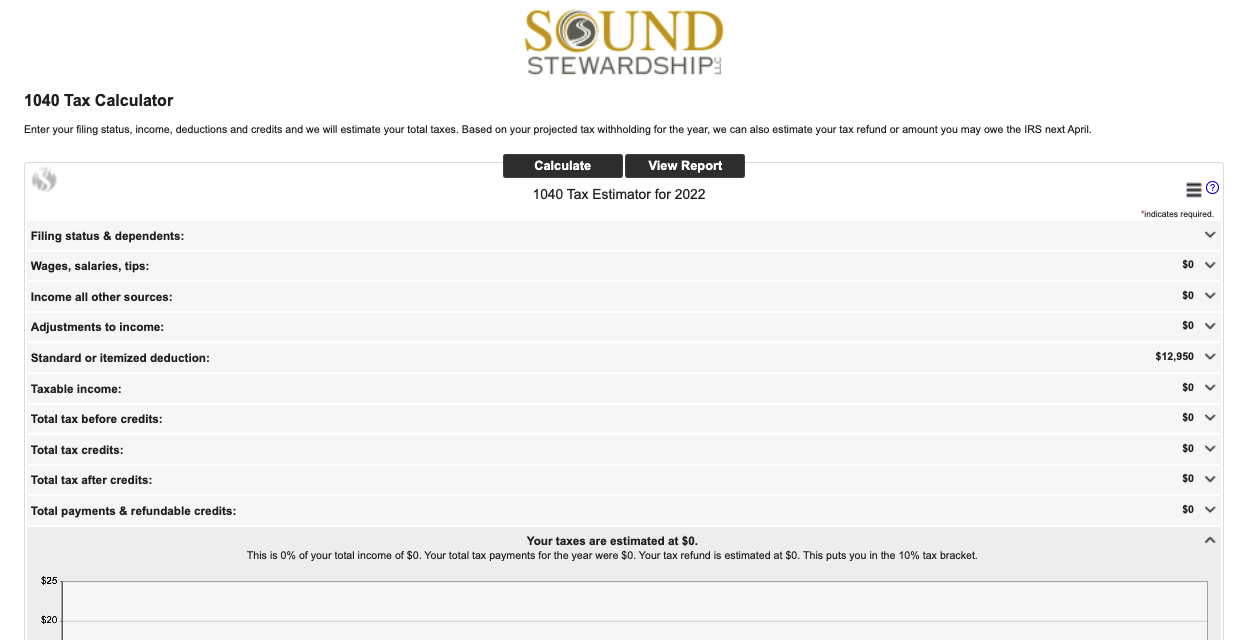

Skip to main app content. Ad Free means free and IRS e-file is included. 1040 Tax Estimation Calculator for 2022 Taxes.

The IRS is expected to give out 128 million refunds for the 2022 tax filing season for the 2021 tax year 31 percent higher than the previous year totaling 355 billion. Find the form you will need in our collection of legal templates. See how your refund take-home pay or tax due are affected by withholding amount.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing. Estimate your federal income tax withholding. Open the document in our.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. Answer the simple questions the calculator asks. And is based on the tax brackets of 2021.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Enter your Annual salary and click enter simple. Use Our Free Powerful Software to Estimate Your Taxes.

Use SmartAssets Tax Return Calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. If you lodge late any tax bill will be due 21 November 2022. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed. This Tax Return and Refund Estimator is currently based on 2022 tax tables. IRS tax forms.

The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Taxable gross annual income subject to personal rates W-2 unearnedinvestment business income not eligible for 20 exemption amount etc.

Prepare and e-File your. And is based on the tax brackets of 2021. You have to give a.

Based on your projected tax withholding for the year we can also estimate your tax refund or. You may be required to make estimated tax payments to. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Use this tool to. Once you have a better understanding how your 2022 taxes will. This calculator is updated with rates.

Enter your filing status income deductions and credits and we will estimate your total taxes. Once you have a better understanding how your 2022 taxes will work out plan accordingly. Irs Tax Refund 2022 Why Do You Owe Taxes This Year Marca 1040 Tax Estimation Calculator for 2022 Taxes.

You dont have to be 100 exact. Ad Enter Your Tax Information. Enter your filing status income deductions and credits and we will estimate your total taxes.

And is based on the tax brackets of 2021. Will display the status of your refund usually on the most recent tax year refund we have on file for you. Keep to these simple instructions to get Irs Tax Refund Calculator completely ready for sending.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Form 1040 Income Tax Return Irs Tax Forms Income Tax

Tax Refund Calendar Date Calculator

Free Tax Calculator Estimate Your Refund For Free Free 1040 Tax Return Com Inc

Tax Accounting Services Accounting Services Tax Refund Tax Services

Tax Year 2022 Calculator Estimate Your Refund And Taxes

Income Tax Calculator Estimate Your Refund In Seconds For Free

Income Tax Calculator 2021 2022 Estimate Return Refund

Pin On Tax Tips For Teachers

Tax Calculator Estimate Your Income Tax For 2022 Free

Take These 5 Steps For A Quicker And Bigger Tax Refund In 2022 Barron S Tax Preparation Tax Preparation Services Tax Services

Tax Year 2022 Calculator Estimate Your Refund And Taxes

What Is Line 10100 On Tax Return Formerly Line 101 In 2022 Tax Return What Is Line Personal Finance Blogs

Sound Stewardship Tax Calculator Sound Stewardship